Member Login

The questions we should all ask on Budget Night

05 May 2017 | Archive

When Treasurer Scott Morrison hands down the Budget next week, we will all be keen to know what it means for us and our families: What will it mean for the taxes we pay and the government programs we use?

While those questions might give us answers about whether we’ll be better off or worse off in the short term, it means we fail to consider whether it helps Australia become more economically competitive.

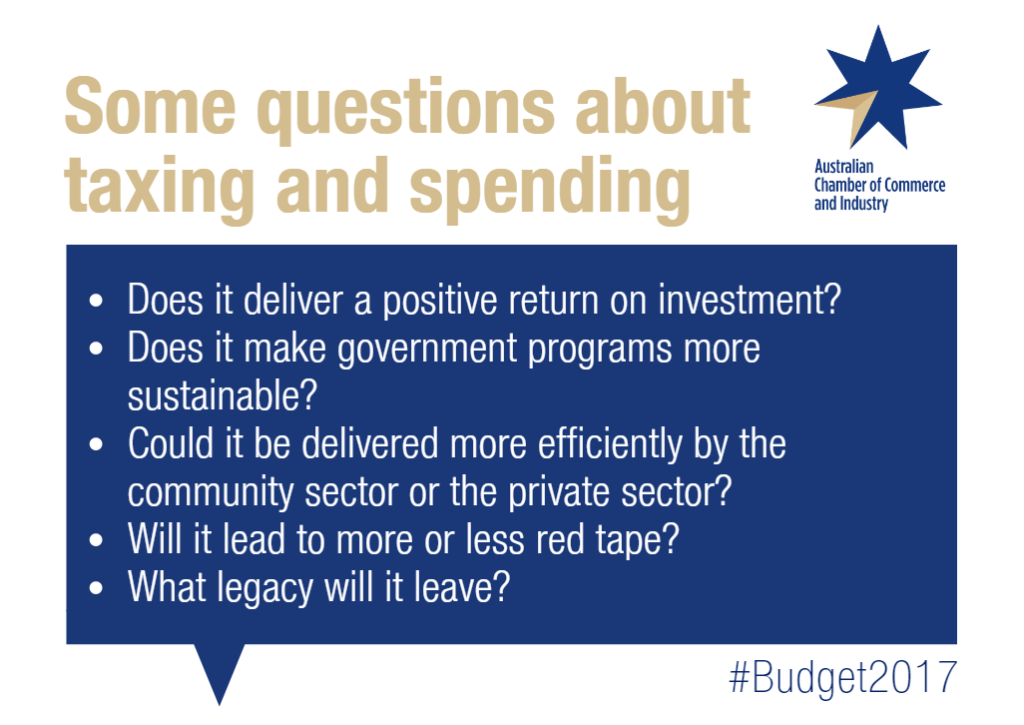

That’s why we need some new questions to judge the Budget. When we hear announcements on spending and tax, here are five questions we should ask:

Does it deliver a positive return on investment?

Not all spending is equal. As anyone who has balanced a household budget knows, there’s a big difference between the things we need and the things we want.

We need to make sure spending builds the economy’s capacity to create jobs and improve living standards. This means we need to skill young people for the jobs of the future and develop infrastructure to move goods, people and information.

We should be cautious about new recurrent expenditure, which will remain a cost burden for years into the future, and focus our efforts on capital expenditure, which will leave a legacy.

And that capital expenditure should face a rigorous cost-benefit analysis so we can be sure it is the best use of taxpayer dollars rather than a political boondoggle.

The need for new infrastructure is clear. For example, the cost of congestion in capital cities ballooned by 30 per cent in the first half of this decade to $16.5 billion, and it could hit $53 billion a year by 2031.

Does it make government programs more sustainable?

Fortunately Australians are living longer, so we need to prepare for the future. The number of people of working age compared to each elderly person has already declined from 7.3 in 1975 to 4.5 in 2015, and is set to fall to 2.7 by 2055.

This means the overall costs of healthcare and pensions will rise significantly as people enter retirement, but there will be fewer people working to pay for them. If we don’t ensure public support is targeted at people who really need it, the capacity of those support programs to make a difference is at risk.

Spending decisions in the Budget need to keep government programs sustainable. With 35 per cent of Federal Government spending going to social security and welfare, and a further 16 per cent going to health, making sure money is well spent can make a big difference to affordability. It is difficult politically but is too important to ignore.

Could a program be delivered more efficiently by the community sector or the private sector?

Even if the government is using taxpayer money to fund a program, it does not mean the government is always best placed to deliver that program. We have seen the way competition has driven down costs and improved innovation in many parts of the economy, but too many public services are shielded from this competition.

In education, health and aged care, many private sector providers could deliver public services, which can improve the experience for users and often ensure better value for money. One study found that cost reductions of 20-25 per cent are not unusual when public services are opened up to competition.

Will a decision create more or less red tape for households and businesses?

In budgets as in life, the devil is in the detail. The best programs in the world will be undermined if the costs of compliance are too great. We know red tape is a headache for many business operators, who need to grapple with business activity statements, superannuation paperwork and development approvals.

In our latest National Red Tape Survey of businesses, more than one in four respondents said they spent at least 11 hours a week on compliance and almost one in two put the annual cost at beyond $10,000.

The Government says it has saved $4.8 billion in red tape compliance costs over the past four years. This is welcome, and it is important that new initiatives do not create red tape in its place.

What legacy will the program leave for future generations?

It is not enough just to consider the trade-offs between different groups in the community. We also need to think about the trade-offs between the current generation and future generations.

A deficit budget, like the ones Australia has had for nearly a decade, mean we are borrowing money today that will create a debt burden for our children and grandchildren. Australia’s gross debt is forecast to exceed half a trillion dollars within months, and rise to $600 billion by 2020. Given the deficit, every dollar of new spending is a dollar extra we will need to borrow.

To make sure our living standards continue to improve, Australia needs to become more competitive. This requires national finances on a credible path to surplus, a tax system that encourages hard work and investment, and a safety net that helps people get back on their feet.

The Budget provides an opportunity to put these ambitions into action.

An edited version of this piece was published in The Advertiser on May 5, 2017.

Related News

ACCI Director joins Deregulation Taskforce

13/09/2019

The Australian Chamber is delighted to announce Bryan Clark, Director of ACCI Trade & International Affairs, has been appointed to the Government’s Deregulation Taskforce, announced...

COAG Call to action on skills

8/08/2019

The Australian Chamber is calling on the country's political leaders to agree to reform our vital Vocation Education and Training (VET) system, to deliver the skills...

Small business deserves a fair go in Fair Dismissal Code

6/08/2019

The Australian Chamber backs the latest call for greater balance in the unfair dismissal system to better support small business owners trying to do the right...

Australian Chamber welcomes moves to cut red tape

5/08/2019

The Australian Chamber of Commerce and Industry welcomes today’s announcement that the Productivity Commission will focus on streamlining regulation in the resources sector. "The joint announcement...

It is time we all acted on the unions’ lawlessness

30/07/2019

By James Pearson, Chief Executive Officer In August 1985 Bob Hawke proclaimed that the Australian government had had enough of “the Building Labourers Federation’s complete...

Time to ensure unions obey our laws and heed our courts

23/07/2019

The Government has called time on union officials with deep pockets, arrogant attitudes, and combative lawyers thumbing their nose at our laws, our courts and...

Maze runner: keeping Australian business competitive in the era of innovation

22/07/2019

By James Pearson It's the year 2030. China has overtaken the US as the world's largest economy. The fastest growing cities are located in...

Union claims exaggerated on union accountability laws

18/07/2019

The Australian Chamber of Commerce and Industry (ACCI), Australia’s employer representative to the United Nations’ International Labour Organisation (ILO), says union opposition to proposed legislation...

Further falls in VET funding reinforces urgent need to prioritise reform

18/07/2019

Today’s release of a report on Government-funded vocational training by the National Centre for Vocational Education Research (NCVER) showing a further decline in investment, reinforces the...

Passage of tax cuts benefits all Australians

4/07/2019

The Australian Chamber of Commerce and Industry, Australia’s largest and most representative business network, warmly welcomes the passage of the personal income tax package through the Senate. “The...

Australian Chamber welcomes the reintroduction of the Ensuring Integrity Bill

4/07/2019

Australia's largest and most representative business network, the Australian Chamber of Commerce and Industry welcomes the Federal Government's reintroduction of the Fair Work (Registered Organisations)...

Business calls on the Parliament to pass personal tax package in full

1/07/2019

Australia’s largest and most representative business network, the Australian Chamber of Commerce and Industry calls on the Parliament to pass the Government’s personal income tax...

Australian Chamber-Tourism welcomes Working Holiday Maker program expansion

1/07/2019

Australian Chamber – Tourism, the peak body of Australia’s tourism organisations welcomes the expansion of the Working Holiday Maker visa program. “The Australian Chamber-Tourism has...

Business welcomes Prime Minister's emphasis on workplace relations and skills

24/06/2019

Australia’s largest and most representative business network, the Australian Chamber of Commerce and Industry, welcomes the Prime Minister’s commitment to review Australia’s Industrial Relations system...

International Visitors Survey continues to highlight positive growth story

19/06/2019

Australian Chamber – Tourism, the peak body of Australia’s tourism organisations, acknowledges the release of the International Visitors Survey today. The survey shows strong performance for...

Industrial sentiment bounces, conditions confirm a loss of momentum

18/06/2019

The Australian Chamber of Commerce and Industry – Westpac Survey of Industrial Trends for the June quarter 2019 released today, shows a slowing in manufacturing business...

Opinion Editorial | It's time to repair, not replace workplace rules

11/06/2019

By James Pearson With the final seats being declared in the federal election, the government and opposition frontbench teams in place and parliament set to...

Economic growth figures underline need to support business to invest and create jobs

5/06/2019

The Australian Chamber of Commerce and Industry, Australia’s largest and most representative business network, today expressed disappointment at the latest National Accounts figures showing lower...

Lower interest rates to boost small business investment

4/06/2019

The Reserve Bank Board’s decision to lower the cash rate to 1.25% today has been welcomed by Australia’s largest business network, the Australian Chamber of...

Business welcomes new Federal Shadow Ministry

3/06/2019

Australia’s largest business network, the Australian Chamber of Commerce and Industry, congratulates the new Labor Shadow Ministry on their appointments and welcomes Federal Opposition Leader Anthony...